BIG SHIP DATA

Why are you here?

256 Trade Routes | 344 Ocean Carriers | 2689 Ocean Carrier Liner Services | 14961 Vessels | 11597 Ports | 126,860 Co-Loader Schedules

Blanked Sailings on Major Asia Outbound Trades

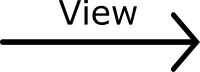

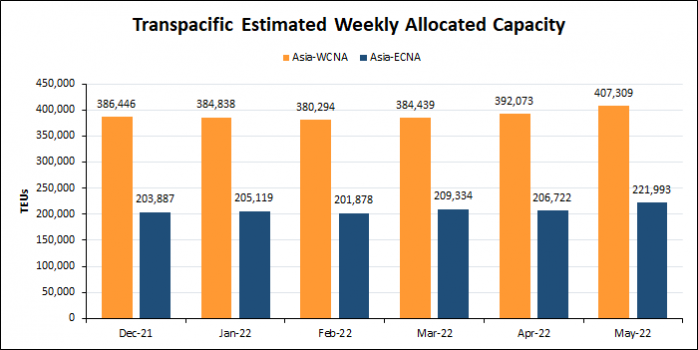

Avg. Weekly Deployed TEUs on trade, Asia to N. America: 439,116

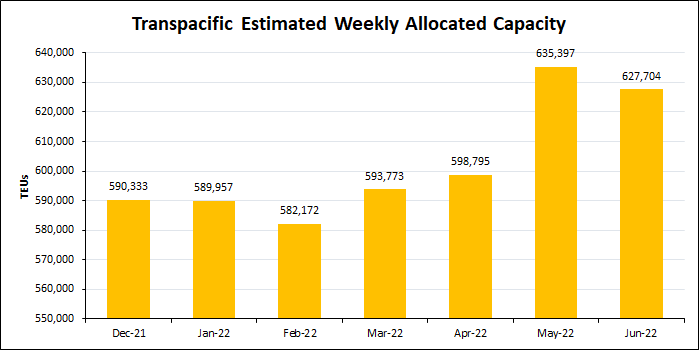

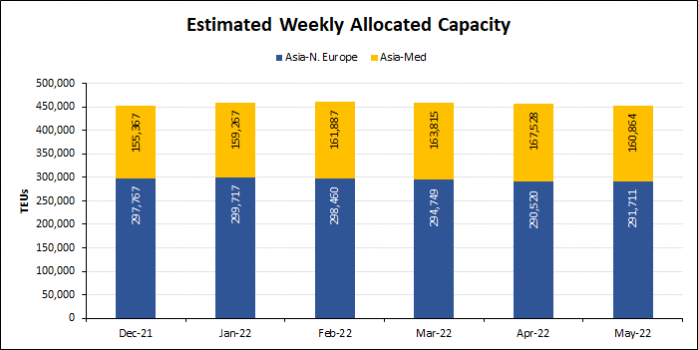

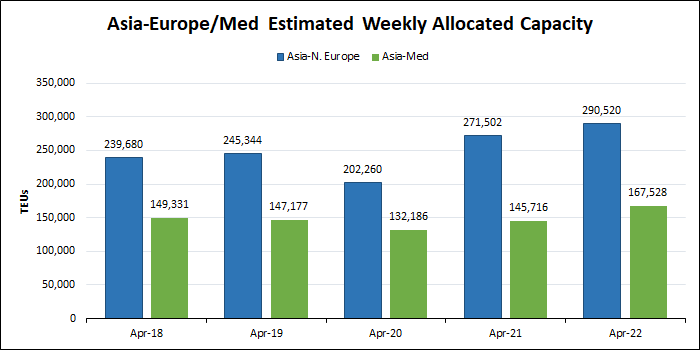

Avg. Weekly Deployed TEUs on trade, Asia to N. Europe/Med: 378,744

Powered By

ServiceTracker

ServiceTracker